The Impact of Free Cash Flow on Market Value of Firm

Teks penuh

Gambar

Dokumen terkait

Hal ini menunjukkan bahwa Profitability (ROA), Likuidity (CR), Free Cash Flow, dan Firm Size dapat mempengaruhi besar kecilnya pembagian Dividend Payout Ratio

From the results of this research that shows, managerial ability has positive impact on firm market value, the owners of the company must be more selective in

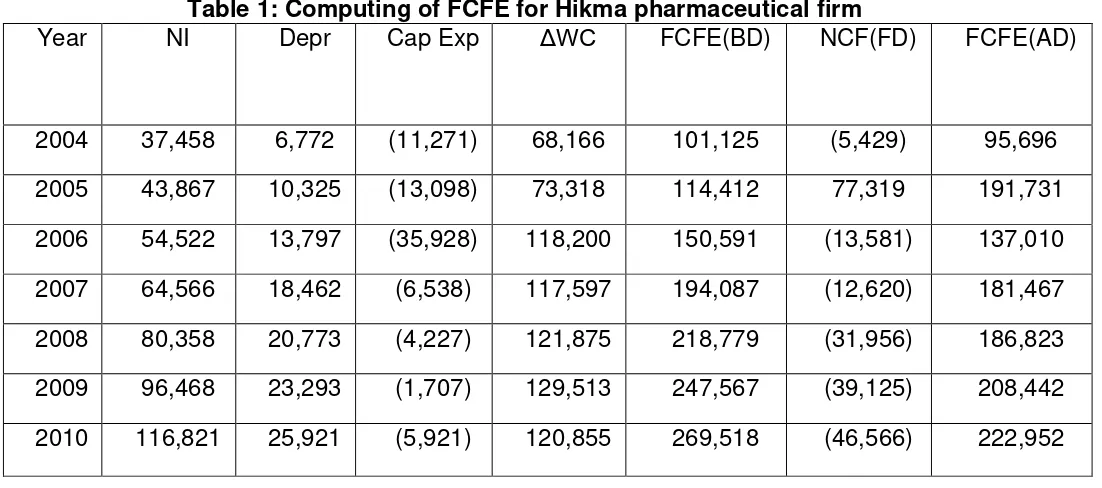

This research is expected contribute to the knowledge in the field of investment and capital market as well as to provide empirical explanation by the influence of free

Because the presence of the free cash flow will create the condition in which dividends will be distributed and this distribution of dividends can raise the stock

“Pengaruh Profitabilitas, Free Cash Flow dan Investment Opportunity Set terhadap Cash Dividend dengan Likuiditas sebagai Variabel Moderating pada

Sedangkani secara simultan (bersamaan) Free Cash Flow, Leverage, Firm Size dan Likuiditas mempunyai pengaruh terhadap Kebijakan Deviden pada perusahaan sektor Property dan

This means that the presence of the free cash flow may split the dividends and thus the dividend policy can increase the firm value.. Dividend payment can raise the

Berdasarkan uraian di atas, maka peneliti tertarik untuk melakukan penelitian yang berjudul “Pengaruh Free Cash Flow, Leverage, Firm Size, dan Profitability Terhadap Harga Saham