Financial Performance 1Q05

Teks penuh

Gambar

Garis besar

Dokumen terkait

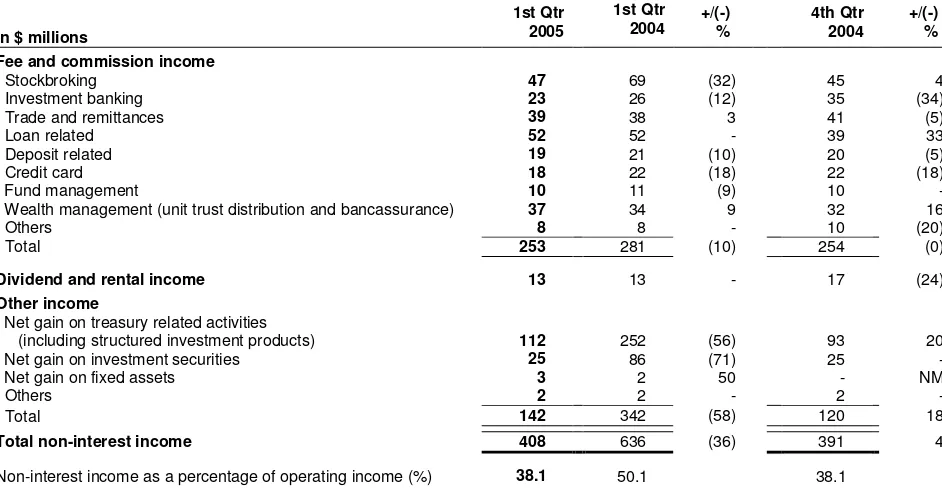

Profit before tax rose 19% from the previous quarter to $800 million as higher total income and lower expenses were partially offset by higher allowances.. Non-interest

Fourth-quarter net profit rose 8% from a year ago to $731 million, driven by higher net interest income partially offset by higher general allowances.. Compared to the previous

Non-interest income fell 19% from the previous quarter as loan-related fees and trading income declined, which were partially offset by better wealth management revenues and

Net profit improved from $65 million in the previous quarter to $190 million as non-interest income rose and both expenses and allowances declined. Net interest income decreased

Specific allowances for loans fell to $68 million, one-fifth the amount in the previous quarter, as charges for corporate loans in Rest of the World declined.. Allowances for

Compared to the previous quarter, GFM’s revenues fell due to lower gains from interest rate and foreign exchange activities as well as lower asset valuation gains.. Expenses

Non-interest income was better than the previous quarter due to capital market and loan syndication fee activities as well as higher trading contributions. Expenses were 4% lower

For second quarter 2005, net profit after taxation for Hong Kong operations on a Singapore GAAP basis declined 17% from second quarter 2004 and 2% from first quarter 2005 to