Tax Avoidance, Corporate Governance and Firm Value in The Digital Era

Teks penuh

Gambar

Dokumen terkait

So it can be concluded that the moderating variable (Sustainability Report) can strengthen the influence of the variables of Capital Structure, Firm Size,

This means that together the higher the value of Good Corporate Governance, the number of Independent Commissioners, the Audit Committee, and the Family Firm will

The results of this research indicate that the Price Earning Ratio (PER), firm size, and Corporate Social Responsibility (CSR) will simultaneously affect the firm value. This

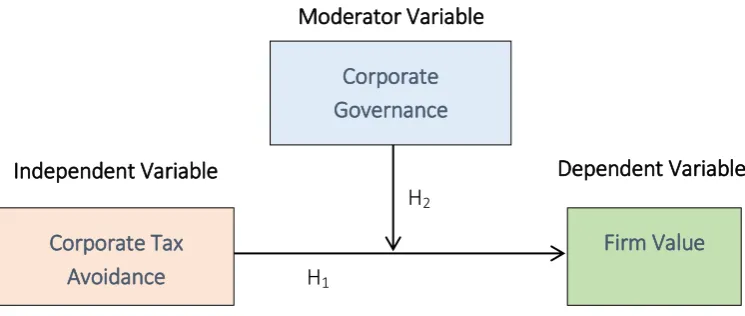

This study aims to examine the effect of corporate social responsibility (independent variable) on firm value (dependent variable) with corporate governance as a moderating

The purpose of this study was to determine the effect of tax aggressiveness, Firm Size, and profitability on Corporate Social Responsibility Disclosure in mining

Jadi dapat disimpulkan bahwa dengan dibangunya sistem perpajakan yang ketat dapat membantu prinsipal untuk tidak perlu lagi mengeluarkan biaya berlebih untuk

Tujuan dari penelitian ini adalah untuk mengetahui dan mengkaji hal-hal yang terkait dengan peningkatan kinerja Lembaga Keswadayaan M asyarakat (LKM ) dalam Program Kota Tanpa

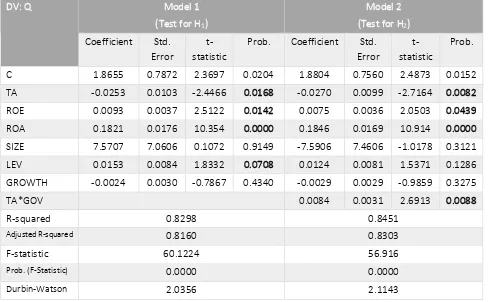

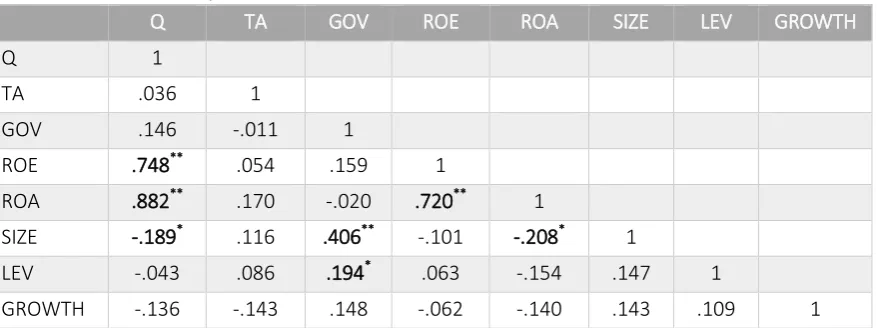

The Moderating Effect of Corporate Governance The results of the fourth hypothesis test showed that corporate governance did not moderate the relationship between firm