Philip Sadler Strategic Management 2nd edition (BookFi)

Teks penuh

Gambar

Dokumen terkait

Overall, the key issue for probabilistic models is the lead time demand. It does not really matter what variations there are outside the lead time, as we can allow for them by

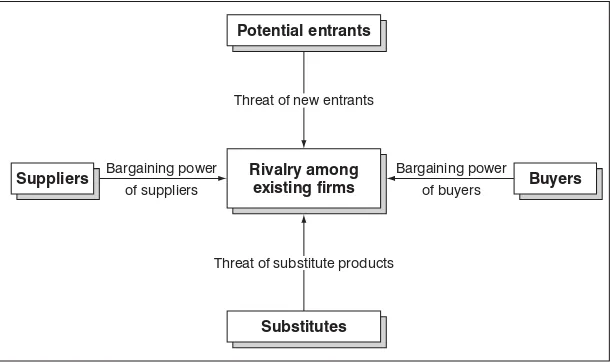

Strategy Management discusses how the organization is run to win the competition. It is all about positioning your own firm to gain competitive advantage. The most

The fundamental thesis of market- orientation (MO) strategy is that, to achieve competitive advantage and superior financial performance, firms should systematically (1)

• The type of action (strategic or tactical) the firm took, the com- petitor’s reputation for the nature of its competitor behavior, and that competitor’s dependence on the market

109 The Effect of Entrepreneurial Orientation on the Competitive Advantage through Strategic Entrepreneurship in the Cafe Business in Ambon Sesilya Kempa1*,Truly Gladys Setiawan 2

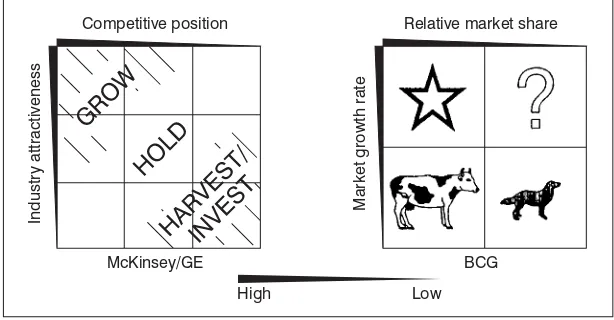

Sustainability Issue: GREEN SUPERCARS 128 Global Issue: SUVs POWER ON IN CHINA 136 Identifying External Strategic Factors 137 Industry Analysis: Analyzing the Task Environment 138

PANASONIC 179 Strategic Marketing Issues 179 Innovation Issue: DOCOMO MOVES AGAINST THE GRAIN 181 Strategic Financial Issues 182 Strategic Research and Development R&D Issues 183

Competitive advantage is the ability of units public market in East Java Province to achieve economic benefits are elaborated through the cheap cost of the process of leasing the