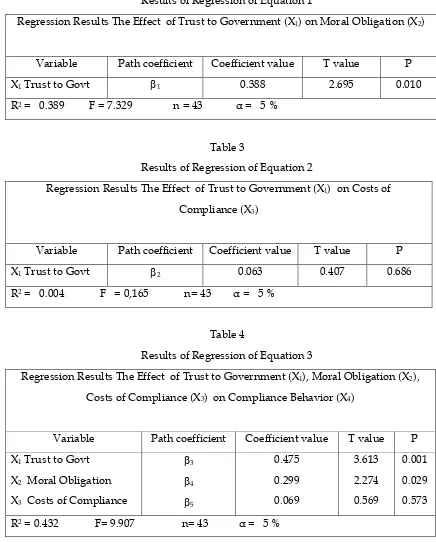

THE EFFECT OF TRUST TO GOVERNMENT, MORAL OBLIGATION AND COMPLIANCE COSTS ON TAXPAYERS COMPLIANCE BEHAVIOR

Teks penuh

Gambar

Dokumen terkait

In summary, surface modifications of CVD manufactured Diamond Films on Si(111) substrate have been successfully performed by Fe+B ions implantation followed by Argon gas

Dengan adanya sistem ini diharapkan mampu mengatasi masalah-masalah yang ada dalam bidang penjualan yang menyangkut kepada hubungan antara perusahaan dengan pelanggan

The results of the study show that price has a positive and significant effect on car purchase decisions.. Promotion has a positive and significant effect on car

The re- sults of this study indicate that religion plays an important role in shaping individual’s attitude and behavior towards tax obligation.. Second, the higher the degree

What is the effect of the simultaneous dissemination of taxation information, tax rates, and tax sanctions on individual taxpayers' annual tax return reporting compliance at

Dengan adanya peningkatan detak jantung pada subjek 1 dapat dilihat bahwa subjek 1 mulai dapat mencerna musik tersebut dengan menyelaraskan dan menerima gelombang-gelombang

The purpose of this research was to find out whether the number of taxpayers, taxpayer compliance, and number of tax inspection have a significant influence

Tekan tombol Ctrl+V , perhatikan nilai-nilai yang muncul pada sel H5 sampai H 19 Lengkapi Tabel tersebut Sesuai dengan