THE IMPACT OF FREE CASH FLOW ON THE FIRM VALUE.

Teks penuh

Gambar

Garis besar

Dokumen terkait

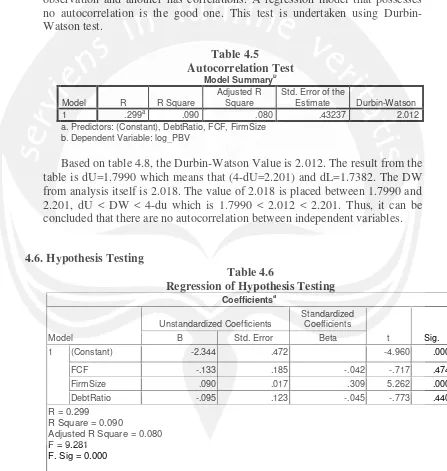

Regression is the model used by this study to test the mediating variable in this case the dividend policy as measured by the dividend payout ratio (DPR) to the

90 STTP-Siantar Top Tbk 91 TALF-Tunas Alfin Tbk 92 TCID-Mandom Indonesia Tbk 93 TIRT-Tirta Mahakam Resources Tbk 94 TOTO-Surya Toto Indonesia Tbk 95

Because the presence of the free cash flow will create the condition in which dividends will be distributed and this distribution of dividends can raise the stock

Sedangkani secara simultan (bersamaan) Free Cash Flow, Leverage, Firm Size dan Likuiditas mempunyai pengaruh terhadap Kebijakan Deviden pada perusahaan sektor Property dan

Perbandingan metode Price Earning Ratio (PER), Free Cash Flow to Equity (FCFE) dan Free Cash Flow to Firm (FCFF) dilakukan untuk mengetahui metode mana yang

The results show that institutional ownership and profitability have negative effect on debt policy, and free cash flow has positive effect on debt policy, while, managerial

Berdasarkan uraian di atas, maka peneliti tertarik untuk melakukan penelitian yang berjudul “Pengaruh Free Cash Flow, Leverage, Firm Size, dan Profitability Terhadap Harga Saham

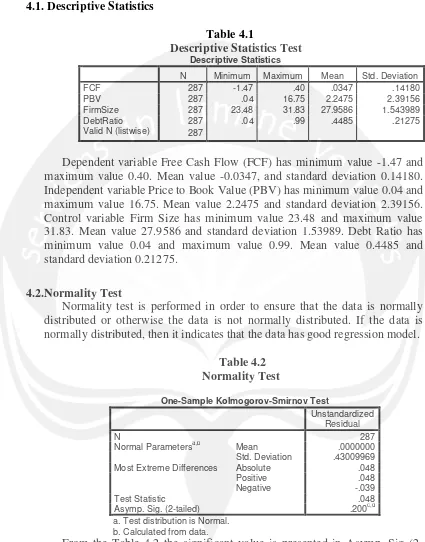

Table 1: Variable definition and measurement Variable Abbreviation Variable Name Measurement Method Dependent Variable FCF Free cash flow EBITDA – taxes – interest paid on debt –